DISABILITY INSURANCE

Disability insurance coverage is designed to provide financial security during a time of non-work related injury or illness. These benefits provide a partial source of income to help you maintain your household expenses while you are out.

Versiti’s Short-Term and Long-Term Disability Carrier is the Hartford.

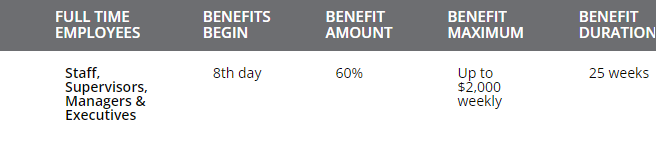

Short-Term Disability (STD) helps to provide partial pay during the first 6 months of your sickness or non-work injury. This is a company paid benefit and available to all full-time benefit eligible employees.

Note – You will be required to supplement disability payments with your accrued PTO.

There is no employee premium cost to employees for this coverage.

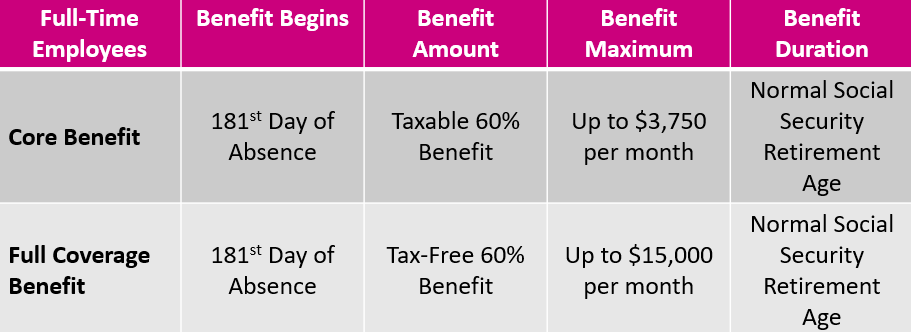

Long-Term Disability (LTD) provides a partial salary replacement for eligible full-time employees who are absent from work for an extended period of time due to a qualified illness or non-work related injury. This benefit begins after Short-Term Disability is exhausted.

Versiti will provide a benefit of 60% of the first $75,000 in covered salary at no cost for all eligible full-time employees. This is a taxable benefit.

For employees earning more than $75,000, you may elect the Full Coverage Option for Long-Term Disability coverage which is a tax-free benefit. Coverage will be 60% up to a maximum of $300,000 of covered salary. If you become disabled, the Full Coverage benefit will not be subject to tax but you have to pay for the benefit with after-tax dollars.

Versiti will contribute to offset a portion of the premium if you elect the Full Coverage option.

If you enroll after first eligible for the Full Coverage as a new hire, you will need to provide evidence of insurability with your election request.

Versiti, Inc. Employer Paid LTD Benefit Highlight Sheet

Versiti, Inc.Voluntary LTD Benefit Highlight Sheet

Versiti Long Term Disability Plan Description

Versiti Long Term Disability-Managers and Above Plan Description

Rates:

All full-time benefit eligible employees will receive the core $75,000 benefit paid by Versiti. There is no employee premium cost to employees for this coverage. Benefits are taxable when paid by the employer.

The cost for the Full Coverage benefit for covered salary over $75,000 is $1.35 per $100 Monthly Benefit.

To determine your monthly premium before the subsidy, use the following steps:

- Enter Annual Earnings (example $80,000 annual earnings) = $80,000

- Calculate monthly earnings (1. Divided by 12) = $6,666.67

- Calculate monthly benefit (2. Multiply by 60%) = $4,000

- Find value per $100 (3. Divided by 100) = $40

- Estimated month contribution (4. Multiplied by $1.35) = $54

Each employee’s specific rate will be calculated based on current salary.

Versiti will also provide the following to offset some employee premium if you elect the Voluntary Full Coverage: $8.25 per pay period

To file a claim or request leave:

- Telephone: 1-888-301-5615 (M-F, 8 a.m. to 8 p.m., ET)

- Policy Number: 715324

- Website: www.thehartford.com/mybenefits

Versiti is committed to provide reasonable accommodations to employees with known disabilities and strives to foster a positive work environment where diversity is embraced.

The American With Disabilities Act (ADA may help an individual if a covered disability impact that person’s ability to perform his or her job. You may request an accommodation when you have either an existing disability or health concern which impacts your ability to perform the essential functions of your job.