2026 Open Enrollment

All full-time employees regularly scheduled to work 30 or more hours a week are eligible for the following benefits:

〉 Health Insurance

〉 Dental Insurance

〉 Vision Insurance

〉 Group & Supplemental Life Insurance

〉 Flexible Spending Accounts (FSA)

〉 Health Savings Account (HSA)

〉 Voluntary Income Protection

〉 Employee Assistance Program (EAP)

〉 Short Term Disability (STD)

〉 Long Term Disability (LTD)

〉 Holiday Pay and Paid Time Off

〉 Retirement Benefits

All part-time employees regularly scheduled to work 20-29 hours a week are eligible for the following benefits:

〉 Health Insurance

〉 Dental Insurance

〉 Vision Insurance

〉 Group & Supplemental Life Insurance

〉 Flexible Spending Accounts (FSA)

〉 Health Savings Account (HSA)

〉 Voluntary Income Protection

〉 Employee Assistance Program (EAP)

〉 Holiday Pay and Paid Time Off

〉 Retirement Benefits

Eligible dependents may also participate if they meet the following criteria:

〉 Your legally married spouse;

〉 Child(ren) who are under age 26, including a natural child, stepchild, a legally adopted child, a child placed for adoption or a child for whom you are the legal guardian;

〉 An unmarried child age 26 or older who is or becomes disabled and dependent upon you;

〉 A child for whom health care coverage is required through a Qualified Medical Child Support Order or other court or administrative order.

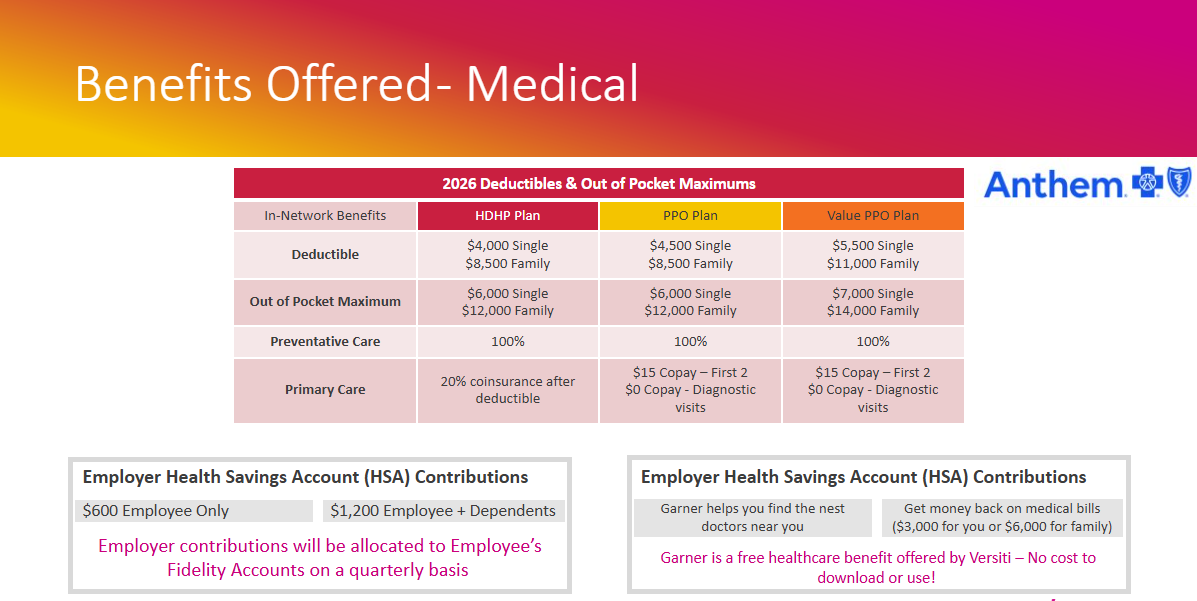

Medical Plans–Three Versiti medical plans to choose from. Please review the plans to find the one that most closely matches your needs.

While the per paycheck rates are not increasing for 2026, the deductibles and out-of-pocket maximums are increasing.

Health Savings Account–The annual limits that you can contribute in 2026 are increasing. Versiti will contribute $600 if you have single HDHP medical plan coverage or $1,200 if you cover any dependents.

If you enroll in the HDHP, Versiti will make quarterly contributions to your Health Savings Account!

- 2026 HSA Maximum Contribution Limits:

- $4,400 Single (this includes the $600 Versiti contribution; the maximum employee contribution is $3,800)

- $8,750 Family (this includes the $1,200 Versiti contribution; the maximum employee contribution is $7,550)

Flexible Spending Account– If you enroll in a Health Care Flexible Spending Account (FSA), the full amount you elect for the year is available to you on January 1. This means that if you incur a large eligible expense early in the year, you can use the entire elected amount upfront, even though the deductions will be spread out across your paychecks throughout the rest of the year.

- 2026 FSA Maximum Contribution Limits:

- Healthcare FSA = $3,400 annual limit with $680 carryover limit to 2027

- Dependent Care FSA = $7,500 annual limit with no carryover

- Limited FSA = $3,400 annual limit with $680 carryover limit to 2027

ALEX is an online tool that walks you through the process of choosing the best benefits for you and provides easy-to-understand explanations for any questions you might have along the way.

Garner – The free Garner benefit is available to employees who are currently enrolled in a Versiti medical plan. The Garner benefit helps you find top-rated doctors in the Anthem network who are identified based on multi-facetted data and not just patient reviews. By using Garner, you may qualify for financial incentives that help cover your out-of-pocket medical expenses.

Life Insurance Open Enrollment – This year Versiti is offering a true “Open Enrollment” for Supplemental Life Insurance. This means that regardless of the coverage you have elected in past year, you can now elect up to the guaranteed issue amount with no required Evidence of Insurability (EOI)! Please take advantage of this great offer!

Versiti currently offers three medical plans in order provide you with options to pick a plan that best suits your needs.

Employees who make changes to medical plan coverage will receive new cards in December from Anthem. Please make sure your address is up to date in Dayforce!

Pharmacy Coverage: CVS Caremark

Versiti’s 2026 pharmacy coverage reflects our commitment to offer a comprehensive and competitive benefits program for you and your family. The pharmacy benefit manager under the Versiti medical plans is CVS Caremark for 2026 and offers convenient and affordable medication options.

Save time, keep costs down and stay on top of your prescriptions. Do it all at Caremark.com and CVS Caremark mobile app.

Three Medical Plans –What is the Same?

- All plans use the same providers/network

- All plans cover the same medical and prescription benefits

Three Medical Plans –What is Different?

- Annual Deductibles and Out of Pocket Maximum

- Copays and co-insurance

Consider your Options

Does the medical plan you chose last year still work for you and your family?

Start by thinking about what is most important to you:

- How much you pay toward the premium each paycheck

- Copays for office visits and prescriptions

- Your annual deductible

- If you enroll in the High Deductible Medical Plan (HDHP), Versiti makes an annual contribution to your Health Savings Account (HSA)

- Whether or not your doctor and hospital are in-network.

- Take advantage of Versiti Medical Plan Prevention Programs

- Annual physical exams are covered at 100% and eligible employees also receive a $250 incentive for having this exam, regardless of which Versiti medical plan you select.

- Free preventive medications to keep chronic conditions under control

- The PPO and Value PPO plan provide 2 free visits a year with your primary health care provider when sick or injured. You don’t have to wait to see your doctor due to cost.

- Versiti contributes $600/$1,200 to your Health Savings Account in 2026 if you are enrolled in the high deductible medical plan. This money is yours to keep for medical expenses. You will not lose that money if you don’t use it in 2026.

The decisions you make during Open Enrollment last for an entire year and can have a large impact on your health and financial well-being. Ensuring you are protected takes careful thought and planning. Review all your benefits and make changes if needed – if you do not go to Dayforce to make any changes, your current insurance coverage will remain in effect, however, participation in spending accounts (flexible spending account, limited purpose spending, dependent care spending, health savings account) will not continue into 2026.

Total medical plan costs under the Versiti medical plans will not increase in 2026. Versiti has in the past and will continue in 2026 to absorb most of the cost increases and will not pass the full employee share of the premium increase to employees.

Medical Plan Premiums 2026 | ||||||

| HDHP | PPO | Value PPO | |||

| Full-Time | Part-Time | Full-Time | Part-Time | Full-Time | Part-Time |

Employee Only | $53.52 | $107.04 | $107.49 | $214.97 | $62.49 | $124.99 |

Employee + Spouse | $126.51 | $253.02 | $236.47 | $472.94 | $137.49 | $274.97 |

Employee + Child(ren) | $115.01 | $230.02 | $214.97 | $429.95 | $124.99 | $249.98 |

Employee + Family | $184.02 | $368.03 | $343.96 | $687.92 | $199.98 | $399.97 |

Dental 2026 Premium Rates – Employee Contributions per Paycheck | ||

2026 Full Time | 2026 Part- Time | |

Employee Only | $4.45 | $8.89 |

Employee + Spouse | $8.89 | $17.78 |

Employee + Child(ren) | $10.92 | $21.83 |

Family | $18.24 | $36.47 |

Vision 2026 Premium Rates – Employee Contributions per Paycheck | |

2026 Full-Time & Part-Time | |

Employee Only | $3.05 |

Employee + Spouse | $6.11 |

Employee + Child(ren) | $6.23 |

Family | $9.29 |

Supplemental Medical Coverage Plan

Who will be eligible for this plan?

Current Versiti medical plan participants and/or dependents who:

- Have access to another employer sponsored medical plan* (not an individual plan, MarketPlace plan, Medicaid or Medicare) are eligible. Plans such as:

- Spouse’s plan

- Second job that offers an employer sponsored plan

- Parent’s plan

*Note: The other plan cannot be a high-deductible health plan with a Health Savings Account

If an employee and/or dependents who is currently enrolled in a Versiti medical Plan (the HDHP, PPO or Value PPO plan) enrolls in other group coverage and drops Versiti medical plan coverage, Versiti will provide funds to pay for out-of-pocket expenses of the other group plan – deductibles, coinsurance, co-pays – generating 100% coverage.

Versiti will also provide a taxable monetary payment on the first and second pay period each month to assist with the other coverage premium payments.

- $50 if one person drops Versiti’s plan and enrolls in other coverage

- $100 if two or more people drop Versiti’s plan and enroll in other coverage

How will this plan work?

Employees will enroll in this plan during Open Enrollment in Dayforce and provide documentation of enrollment in another employer sponsored medical plan to HR4You. Once qualified participants have 2026 in-network medical or pharmacy claims, they will submit an Explanation of Benefits (EOB) document from the other employer sponsored medical plan to Fidelity, the claims administrator for this plan. Once the claim is verified, Fidelity will reimburse out of pocket expenses (deductibles, co-pays, coinsurance) directly to the employee through a check or direct deposit.

What Plan to Choose?

Now that you’ve had some time to review the medical plan benefits and changes for next year, what are some things you should think about when making your benefit elections?

- Consider how often you use medical care and what out-of-pocket expenses you may have regularly and compare those against each plan’s benefits.

- Are your medical providers in-network?

- How will you pay for the out-of-pocket expenses the medical plan doesn’t cover? If you enroll in the High-Deductible Health Plan, consider the HSA with all the tax saving benefits it has to offer. If you enroll in one of the PPO options, consider using the Flexible Spending Account to pay for your out-of-pocket expenses.

- If you have access to coverage through another employer sponsored medical plan, is the Supplemental Medical Coverage Plan a good option for you and/or your dependents?

Voluntary Income Protection Benefits

Medical insurance is designed to provide preventative care to help you stay healthy, as well as to help cover treatment due to an accident or illness. Protecting your income if you are sick or injured for either a short or extended period of time is important. We want to help our employees think differently about financial well-being and are pleased to offer comprehensive voluntary benefits for out-of-pocket medical expenses.

Versiti is proud to offer Accident, Critical Illness and Hospital Indemnity insurance as Voluntary Income Protection plans for our employees. These plans pay lump-sum cash benefits if you (or a family member) have an accident, hospital stay or diagnosis of a specific illness. This lump-sum benefit helps cover out-of-pocket medical expenses or help cover things like rent, groceries, and childcare to help make up for lost wages. Also, these plans offer an annual wellness benefit ranging from $50-$100 per individual if you receive a preventive visit or screening.

For additional information related to Accident, Critical Illness and Hospital Indemnity benefits, please review the videos from The Hartford:

Accident | |

Critical Illness | |

Hospital Indemnity |

- Brenda is healthy but fell over the weekend setting up Halloween decorations breaking her leg

- She goes to the Emergency room, has an X-ray and leaves with a cast

- Because she is on the Accident plan, she receives $200 for the ER, $40 for the X-ray, and $1,800 for the fractured leg. She will also receive $50 from The Hartford for Wellness Screening

- Brenda will also receive $250 from Versiti’sWell-Being Program for completing Brenda’s annual health exam if done before 12/31/2026

- Because she is also in the HDHP, she could use Versiti’s$600 HSA contribution to also help cover her costs

Life insurance

Versiti provides Life insurance and Accidental Death & Dismemberment Insurance to all full-time and part-time employees. The benefit amount is 2x your salary. The benefit maximum is $50,000 for part-time employees and $700,000 for full time employees.

For additional information related to Life and Accidental Death and Dismemberment benefits, please review the videos from The Hartford:

Life | |

AD&D |

Does your Versiti paid life and AD&D insurance meet your needs?

- Are you the primary household income earner?

- Do you have a mortgage, college loans or other debt that is unpaid?

- How would your family support themselves if you passed away?

- Could your family afford your medical bills and/or funeral costs?

- Would your loved ones have the burden of paying any debt or other financial responsibilities that you leave behind?

Remember! You can receive extra protection and enroll in voluntary life insurance. You have the option to apply for higher amounts during open enrollment by completing your enrollment in Dayforce.

Use this calculator to determine how much life insurance might be right for you: Life Calculator

Long Term Disability Insurance

1 in 4 of today’s 20-year-olds are expected to be out of work for at least a year because of a disabling condition before retirement. Versiti helps protect your income if you are out of work by enrolling all eligible full-time employees in Core LTD insurance, which provides a benefit of 60% of the first $75,000 in covered salary at no cost. This is a taxable benefit.

If you make over $75,000 you may need additional LTD coverage. In this event, you may elect the Full Coverage Option for Long-Term Disability coverage which is a tax-free benefit. Coverage will be 60% up to a maximum of $300,000 of covered salary. If you become disabled, the Full Coverage benefit will not be subject to tax but you have to pay for the benefit with after-tax dollars. Versiti will contribute to offset a portion of the premium if you elect the Full Coverage option

Use this calculator to determine if the Full LTD plan might be right for you: Disability Calculator

If this is your first time enrolling in the Full Coverage LTD insurance, you will need to provide evidence of insurability to The Hartford. Take advantage of this opportunity if Full LTD Coverage is right for you!

For additional information related to Disability benefits, please review the below training video from The Hartford:

Disability |

Please make sure to go in and enroll in your benefits for the 2026 plan year between October 27th and November 7th.

REMEMBER! If you do not go in and update your elections, you will not have FSA or HSA in 2026.

How to Enroll

〉 Log in to DayForce

〉 Click on the Benefit Icon

〉 Select 2026 Open Enrollment

Provide Your Household Information

〉 Provide your dependent’s information

- You must add your dependents that you wish to cover under your benefits first before electing your benefit plans

〉 Are the people you cover under the plan eligible family members?

- Versiti is committed to the wellbeing of you and your eligible family members. To continue that commitment, we need to confirm that the people you cover under the plans are eligible. Please review your family members and remove any that are not eligible. Eligible dependents are:

- Legally married spouse, dependent children, legally adopted children, foster children that live with you, children that you have legal guardianship and stepchildren (children can be covered until the end of the month they turn 26).

〉 Provide your beneficiaries for life insurance

〉 Are the people you cover under the plan eligible family members?

- Versiti is committed to the wellbeing of you and your eligible family members. To continue that commitment, we need to confirm that the people you cover under the plans are eligible. Please review your family members and remove any that are not eligible. Eligible dependents are:

- Legally married spouse, dependent children, legally adopted children, foster children that live with you, children that you have legal guardianship and stepchildren (children can be covered until the end of the month they turn 26).

Make Your 2026 Benefits Elections

〉 Enroll or waive in all benefit options (medical, dental, vision, life, HSA, FSA, etc.)

〉 Confirm the level of coverage you would like

〉 Deadline to enroll – You must enroll between October 27th and November 7th

Finalize Your Enrollment

〉 Review your 2026 elections

〉 Confirm ALL information is accurate

〉 Click “Submit Enrollment”

〉 Print your 2026 benefit confirmation statement for your records

〉 Confirm Your Contact Information

〉 Click on the “Forms” Icon

〉 Under “Personal”, confirm your address, phone number, and email address are current