HEALTH SAVINGS AND FLEXIBLE SPENDING ACCOUNTS

If you will have out-of-pocket health and/or dependent care expenses in 2026, it may benefit you to take advantage of the Health Savings Account (HSA) and/or Flexible Spending Account (FSA) plans made available to you by Versiti. These savings accounts can help you plan, budget and save on the cost of what you pay for health and dependent day care.

Versiti’s Health Savings and Flexible Spending Accounts are administered by Fidelity.

What is a Health Savings Account?

To learn more about HSA’s, please visit what this brief information video from Fidelity.

An HSA is an individual account used in conjunction with a High Deductible Health Plan, to cover out-of-pocket qualified medical expenses on a tax-advantaged basis. Your HSA belongs entirely to you and can be used to pay for both current and future qualified medical expenses for you and your eligible dependents. You can contribute to your account, withdraw contributions to pay for current qualified medical expenses, and potentially grow your account on a tax-free basis by investing your savings in a wide array of investment options.

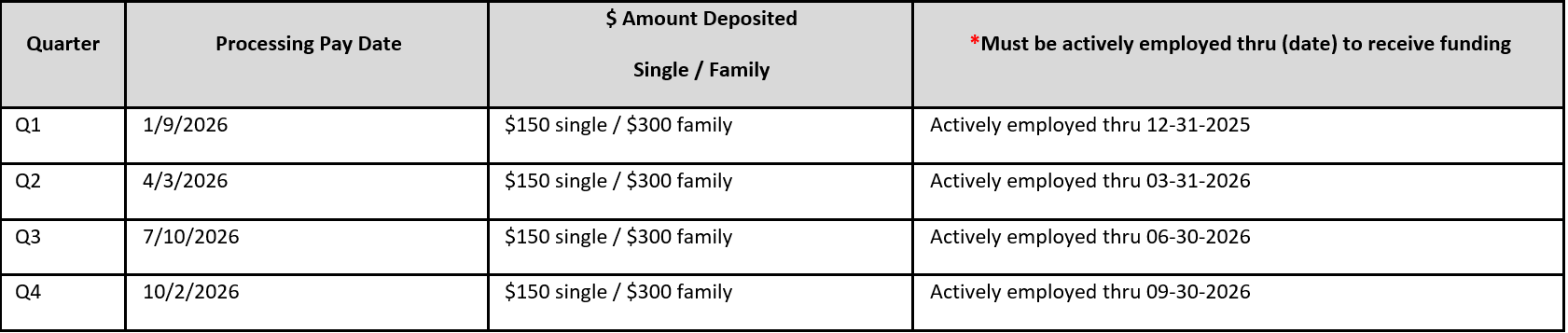

If you enroll in Versiti’s High Deductible Health Plan for medical coverage and open up an HSA account, the company will also contribute money to your account on a quarterly basis, based on the coverage level you’ve elected:

〉 $600 single coverage

〉 $1,200 family coverage

Below is the funding schedule for active employees:

** Please note that the funding will be prorated based on the benefits effective date for those employee enrolling in an HSA for the first time as a new hire or with a qualifying life event:

2026 Health Savings Account (HSA) – IRS Annual Limits (Employer + Employee):

〉 Employee Only – $4,400

〉 Employee plus Spouse/Dependents – $8,750

〉 Employees Age 55 or Older – can contribute an additional $1,000

You must be enrolled in a high deductible health plan (HDHP) in order to establish and contribute to an HSA, and you cannot have any disqualifying health coverage.

〉 You must not be covered in any other non-high deductible health plan (HDHP) including that of a spouse

〉 You must not enroll in Medicare

〉 You must not be claimed as a dependent for tax purposes

What is a Health Care Flexible Spending Account?

Watch this brief informational video and review the information below to learn more!

A health care FSA allows you to set aside pre-tax money through payroll deductions to use for certain expenses not paid by your medical/dental/vision plans. Common eligible medical expenses include:

〉 Medical co-payments

〉 Prescription drugs

〉 Contact lenses

〉 Dental services

2026 Healthcare Flexible Savings Account (HCFSA) – IRS Annual Limit

〉 $3,400

Rollover Period

If you have HCFSA funds left over on December 31, 2026 you may roll over $680 into the next plan year. All claims for 2026 reimbursement must be received by Fidelity by March 31, 2027.

Note: if you participate in Versiti’s High Deductible Health Plan, you are not eligible to contribute to a health care FSA, but you can contribute to a Limited-Purpose Health Care FSA.

FSA Benefits Quick Start Guide

If you participate in Versiti’s HSA, you may contribute to the Limited Health Care Flexible Spending Account; or a limited-purpose FSA.

IRS rules do not allow you to contribute to a health savings account (HSA) if you are covered by any non-qualifying health plan, including a general-purpose health FSA. By limiting FSA reimbursements to dental and vision care expenses, you (or your spouse) remain eligible to participate in both a limited-purpose FSA and an HSA. Participating in both plans allows you to maximize your savings and tax benefits.

A limited-purpose FSA is much like a general-purpose health FSA in that money is set aside from your paycheck before taxes are deducted. You can then use your pre-tax FSA dollars to pay for eligible expenses. However, under a limited-purpose FSA, eligible expenses are limited to qualifying dental and vision expenses for you, your spouse, and your eligible dependents.

2026 Limited Purpose Flexible Savings Account (HSA) – IRS Annual Limit

〉 $3,400

Rollover Period

If you have HCFSA funds left over on December 31, 2026 you may roll over $680 into the next plan year. All claims for 2026 reimbursement must be received by Fidelity by March 31, 2027.

The use of Dependent Care Flexible Spending account (DCFSA) can help offset expenses you may incur for the cost of daycare for your dependents, day camp in lieu of day care, before/after school care, or adult day care. Your daycare provider must provide you with a tax identification number or Social Security number for reimbursements under this account.

2026 Dependent Care Flexible Savings Account (DCFSA) – IRS Annual Limit

〉 $7,500

Dependent Care Flexible Spending Accounts have a “use it or lose it” rule meaning the IRS requires you to forfeit any unspent funds at the end of the plan year. All claims for 2026 reimbursement must be received by Fidelity by March 31, 2027.