MEDICAL/RX INSURANCE

Want more information on Medical Insurance and help understanding insurance terminology?

Watch this short informational video and review the information below to learn more about the Medical Insurance offerings at Versiti.

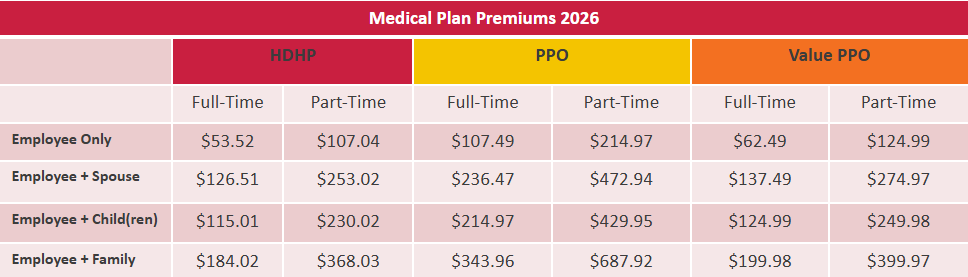

As an eligible employee of Versiti, you may choose the benefit coverage that fits you and your family’s need. You have a choice between three medical plans administered by Anthem

〉 High Deductible Health Plan

〉 PPO Plan

〉 Value PPO Plan

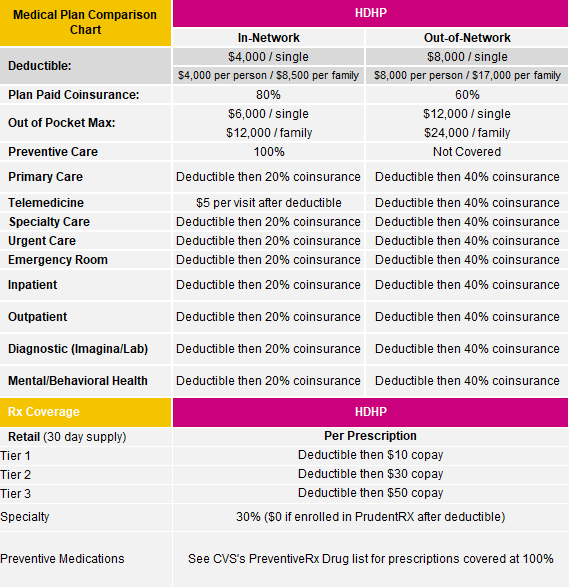

HDHP Plan:

〉 Lower Monthly Premiums

〉 Must reach Deductible before plan starts to pay

〉 No Copays

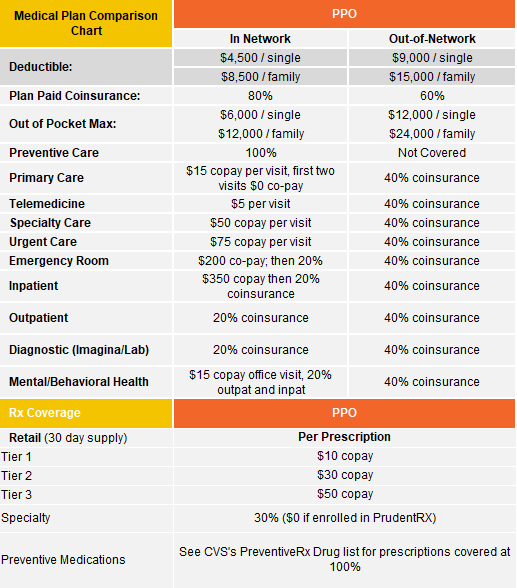

PPO Plan:

〉 Higher Monthly Premium

〉 Lower Deductible

〉 Lower Out-of-Pocket Max

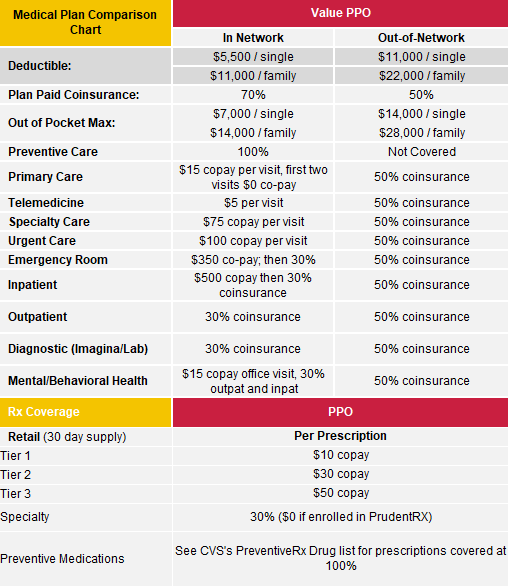

Value PPO Plan:

〉 Lower Monthly Premium

〉 Higher Deductible

〉 Higher Out-of-Pocket Max

All plans offer;

〉 Comprehensive health care coverage

〉 In-Network and Out-of-Network Providers

〉 100% In-Network Preventative Care

Deductible Differences:

〉 All plans have an embedded deductible where the individual deductible applies for each covered person then the coinsurance benefit applies.

Picking the best health plan for you and your family is important and your needs can vary each year. These 7 Tips (video) can assist in making the best decision for you and your family.

HDHP Plan Summary of Benefits 2026

PPO Plan Summary of Benefits 2026

Value PPO Plan Summary of Benefits 2026

The High Deductible Health Plan has an embedded deductible where the individual deductible applies for each covered person then the coinsurance benefit applies.

Definition of Drug Tiers

Click here for the Versiti- CVS Preventive Drug List

Tier 1 drugs have the lowest cost share for you. These are usually generic drugs that offer the best value compared to other drugs that treat the same condition.

Tier 2 drugs have a higher cost share than Tier 1. They may be preferred brand drugs, based on how well they work and their cost compared to other drugs used for the same type of treatment. Some are generic drugs that may cost more because they’re newer to the market.

Tier 3 drugs have a higher cost share. They often include non-preferred drugs and generic drugs. They may cost more than drugs on lower tiers that are used to treat the same condition. Tier 3 may also include drugs that were recently approved by the FDA.

Specialty brand and generic drugs have the highest cost share and may include drugs recently approved by the FDA or used to treat serious, long-term health conditions that may need special handling.

PPO Plans has an embedded deductible where the individual deductible applies for each covered person then the coinsurance benefit applies.

Definition of Drug Tiers

Click here for the Versiti- CVS Preventive Drug List

Tier 1 drugs have the lowest cost share for you. These are usually generic drugs that offer the best value compared to other drugs that treat the same condition.

Tier 2 drugs have a higher cost share than Tier 1. They may be preferred brand drugs, based on how well they work and their cost compared to other drugs used for the same type of treatment. Some are generic drugs that may cost more because they’re newer to the market.

Tier 3 drugs have a higher cost share. They often include non-preferred drugs and generic drugs. They may cost more than drugs on lower tiers that are used to treat the same condition. Tier 3 may also include drugs that were recently approved by the FDA.

Specialty brand and generic drugs have the highest cost share and may include drugs recently approved by the FDA or used to treat serious, long-term health conditions that may need special handling.

PPO Plans has an embedded deductible where the individual deductible applies for each covered person then the coinsurance benefit applies

Definition of Drug Tiers

Click here for the Versiti- CVS Preventive Drug List

Tier 1 drugs have the lowest cost share for you. These are usually generic drugs that offer the best value compared to other drugs that treat the same condition.

Tier 2 drugs have a higher cost share than Tier 1. They may be preferred brand drugs, based on how well they work and their cost compared to other drugs used for the same type of treatment. Some are generic drugs that may cost more because they’re newer to the market.

Tier 3 drugs have a higher cost share. They often include non-preferred drugs and generic drugs. They may cost more than drugs on lower tiers that are used to treat the same condition. Tier 3 may also include drugs that were recently approved by the FDA.

Specialty brand and generic drugs have the highest cost share and may include drugs recently approved by the FDA or used to treat serious, long-term health conditions that may need special handling.

If you’re a member:

〉 Go to anthem.com and log in

〉 Select the type of provider, specialty, zip code, search distance or narrow down even more with name of the provider. Choose Search to see your results.

If you’re not a member yet:

〉 Go to anthem.com and choose Find Care

〉 Choose “Basic Search as a Guest”

- Select “Medical or Network (may also include dental, vision, or pharmacy benefits)” as the type of care you are searching for

- Choose the applicable state you are searching in

- Choose “Medical (Employer-Sponsored)” as the type of plan you want to search with

- Select “Blue Access (PPO) or Wisconsin Residents: Select “Blue Preferred Plus POS w/ Pref Retail Clinics”

- Click Continue

〉 Select the type of provider, specialty, zip code, search distance or narrow down even more with name of the provider. Choose Search to see your results

Knowing where to get care is important and can help you save money on your health care expenses. Watch this video for tips on where to get care for your medical condition.

Find a Doctor Brochure (Blue Access PPO)

Save time, keep costs down and stay on top of your prescriptions. Do it all at Caremark.com and CVSCaremark™ mobile app.

- Find a network pharmacy to keep medication costs as low as possible

- See if a medication is covered to get the most affordable option

- Compare drug costs to see where you can save

- Sign up to get email or text messages about your prescriptions and more

- Request refills and keep track of prescriptions for your family

Please click the link below to see the new Preventive Drug List.

Versiti CVS Preventive Drug List

In order to get a 90-day supply of maintenance drugs, the prescription must be filled at a CVS pharmacy or CVSCaremark™ Mail Service. Members will no longer be able to get a 90-day supply at other pharmacies.

Caremark MailService Flier

Specialty Overview Member Flier

Caremark Generics Flier

01-2026 Advanced Control Formulary

Family Access – Managing Your Family’s Prescriptions

Maintenance Choice Mandatory Opt-Out

National Network Participating Pharmacy List

In order to provide a comprehensive and cost-effective prescription drug program for you and your family, Versiti has contracted with PrudentRx to offer the PrudentRx Copay Program for certain specialty medications.

The PrudentRx Copay Program assists members by helping them enroll in manufacturer copay assistance programs. Members who have the Versiti PPO or Value PPO Plan who enroll in PrudentRx, will have a $0 out-of-pocket responsibility for their prescriptions covered under the PrudentRx Copay Program. Members who have the Versiti HDHP Plan who enroll in PreduentRx, will have a $0 out-of-pocket responsibility after the deductible has been met for their prescriptions covered under the PrudentRX Program.

If you currently take one or more medications included in the PrudentRx Program Drug List, you will receive a welcome letter and phone call from PrudentRx that provides specific information about the program as it pertains to your medication.

True Accumulator– Some specialty medications may qualify for third-party copayment assistance programs that could lower your out of-pocket costs for those products. For any such specialty medication where third-party copayment assistance is used, only the amount the member actually pays will be applied to the deductible and out-of-pocket max (the amount saved when a member uses the card will not be applied)

Who will be eligible for this plan?

Current Versiti medical plan participants and/or dependents who:

- Have access to another employer sponsored medical plan* (not an individual plan, MarketPlace plan, Medicaid or Medicare) are eligible. Plans such as:

- Spouse’s plan

- Second job that offers an employer sponsored plan

- Parent’s plan

- Have access to another employer sponsored medical plan* (not an individual plan, MarketPlace plan, Medicaid or Medicare) are eligible. Plans such as:

*Note: The other plan cannot be a high deductible health plan with a Health Savings Account

Once qualified participants have 2026 medical or pharmacy claims, they will submit an Explanation of Benefits (EOB) document

If an employee and/or dependents who is currently enrolled in a Versiti medical Plan (the HDHP, PPO or Value PPO plan) enrolls in other group coverage during open enrollment or due to a qualifying life event and drops Versiti medical plan coverage, Versiti will provide funds to pay for out-of-pocket expenses of the other group plan – deductibles, coinsurance, co-pays – generating 100% coverage.

Versiti will also provide a taxable monetary payment on the first and second pay period each month to assist with the other coverage premium payments.

- $50 if one person drops Versiti’s plan and enrolls in other coverage

- $100 if two or more people drop Versiti’s plan and enroll in other coverage

How will this plan work?

Employees will enroll in this plan during Open Enrollment or a Life Event Declaration-Gained Other Coverage in Dayforce and provide documentation of enrollment in another employer sponsored medical plan to HR4You.

Once qualified participants have 2026 medical or pharmacy claims, they will submit an Explanation of Benefits (EOB) document from the other employer sponsored medical plan to Fidelity, the claims administrator for this plan.

Once the claim is verified, Fidelity will reimburse out of pocket expenses (deductibles, co-pays, coinsurance) directly to the employee through a check or direct deposit.

Anthem users have exclusive access to the Thrive and Bloom programs to have even more opportunities for great care. Thrive is a virtual Physical Therapy program with proven results to treat, predict, and prevent future conditions and procedures. Bloom is an at-home pelvic health tool that is great for employees who are pregnant, post-partum, menopausal or suffer from bladder issues.

If you use tobacco products, which include e-cigarettes or smokeless products such as chewing tobacco, you will need to disclose your tobacco user status at time of your online enrollment in DayForce. Employees enrolled in a Versiti medical plan will be charged $50/month if not tobacco free at the time of enrollment.

Sydney Health App | Anthem App Download | Anthem

Download the Anthem and CVS mobile app to find a provider, check insurance information and access other tools and resources available to you.

Brand Name Drugs

Drugs that have trade names and are protected by patents. Brand name drugs are generally the most costly choice.

Claim

The bill that you or your doctor or health care provider submit to the plan for payment.

Coinsurance

The percentage of a covered charge paid by the plan.

Copayment (Copay)

A flat dollar amount you pay for medical or prescription drug services regardless of the actual amount charged by your doctor or health care provider.

Deductible

The annual amount you and your family must pay each year before the plan pays benefits.

Explanation of Benefits (EOB)

A document available to you on myuhc.com after you have a health care service that was paid. The EOB provides information about how your insurance claim was paid on your behalf – useful information to help you track your expenditures and the medical services you received.

Generic Drugs

Generic drugs are less expensive versions of brand name drugs that have the same intended use, dosage, effects, risks, safety, and strength. The strength and purity of generic medications are strictly regulated by the Federal Food and Drug Administration (FDA).

Health Savings Account (HSA)

A tax-free savings account where funds are earmarked exclusively for medical expenses (including deductibles and coinsurance).You own and control the money in your HSA, and funds roll over from year to year – it’s yours to keep even if you leave the company.

High Deductible Health Plan (HDHP)

A medical plan that may be used in conjunction with a Health Savings Account (HSA).

In- And Out-of-Network

An in-network provider is someone who has a contract with health insurance carriers and agrees to charge lower fees for people enrolled in the plan. An out-of-network provider is someone who does not have a contract with health insurance carriers. The plan will cover more of the costs of services when you use in-network providers.

Mail Order Pharmacy

Mail order pharmacies generally provide a 90-day supply of a prescription medication for the same cost as a 60-day supply at a retail pharmacy. Plus, mail order pharmacies offer the convenience of shipping directly to your door.

Out-of-Pocket Maximum

The maximum amount you and your family must pay for eligible expenses each plan year. Once your expenses reach the out-of-pocket maximum, the plan pays benefits at 100% of eligible expenses for the remainder of the year.

Premium

The amount you pay for your share of the cost of the plan (deducted from your paycheck on a pre-tax basis).